Mortgage Lenders In Knoxville Tn - The Facts

Table of ContentsFascination About Mortgage Lenders In Knoxville TnThe Best Strategy To Use For Mortgage Companies In Knoxville TnMortgage Companies In Knoxville Tn Things To Know Before You Get ThisThe Greatest Guide To Mortgage Lenders In Knoxville TnRumored Buzz on Mortgage Lenders In Knoxville TnMortgage Lenders In Knoxville Tn for Beginners

A home loan is a kind of financing used to purchase or keep a residence, land, or various other types of genuine estate.Home loan types differ based on the needs of the customer, such as conventional and fixed-rate finances. Home loans are car loans that are utilized to purchase homes as well as other kinds of real estate.

The cost of a mortgage will certainly depend upon the kind of finance, the term (such as thirty years), as well as the rate of interest price that the lender costs. Home loan prices can differ extensively relying on the kind of product as well as the qualifications of the candidate. People as well as organizations utilize home mortgages to acquire property without paying the entire acquisition rate up front.

Fascination About Mortgage Lenders In Knoxville Tn

This means that the normal settlement amount will certainly stay the very same, however different percentages of principal vs. passion will certainly be paid over the life of the funding with each payment. Regular mortgage terms are for 30 or 15 years.

A residential property buyer pledges their house to their loan provider, which after that has an insurance claim on the residential property. In the situation of a repossession, the lending institution may evict the locals, offer the residential or commercial property, as well as make use of the cash from the sale to pay off the home mortgage financial debt.

Being pre-approved for a home mortgage can offer buyers an edge in a tight real estate market because sellers will certainly recognize that they have the cash to back up their offer. Once a buyer and also vendor settle on the terms of their offer, they or their agents will meet at what's called a closing.

Rumored Buzz on Mortgage Lenders In Knoxville Tn

The seller will certainly transfer possession of the residential property to the purchaser and also receive the agreed-upon sum of cash, and the buyer will sign any kind of continuing to be mortgage records. There are hundreds of options on where you can obtain a mortgage.

Despite which alternative you select, contrast rates throughout kinds to make sure that you're obtaining the best offer. Home loans can be found in a range of types. One of the most usual types are 30-year as well as 15-year fixed-rate mortgages. Some mortgage terms are as brief click here for more info as five years, while others can run 40 years or longer.

The basic type of home loan is fixed-rate. With a fixed-rate mortgage, the rates of interest stays the exact same for the entire term of the car loan, as do the customer's month-to-month settlements towards the mortgage. A fixed-rate mortgage is additionally called a conventional mortgage. With an adjustable-rate home loan (ARM), the rate of interest price is repaired for a preliminary term, after which it can alter occasionally based upon dominating rate of interest rates.

Not known Factual Statements About Mortgage Lenders In Knoxville Tn

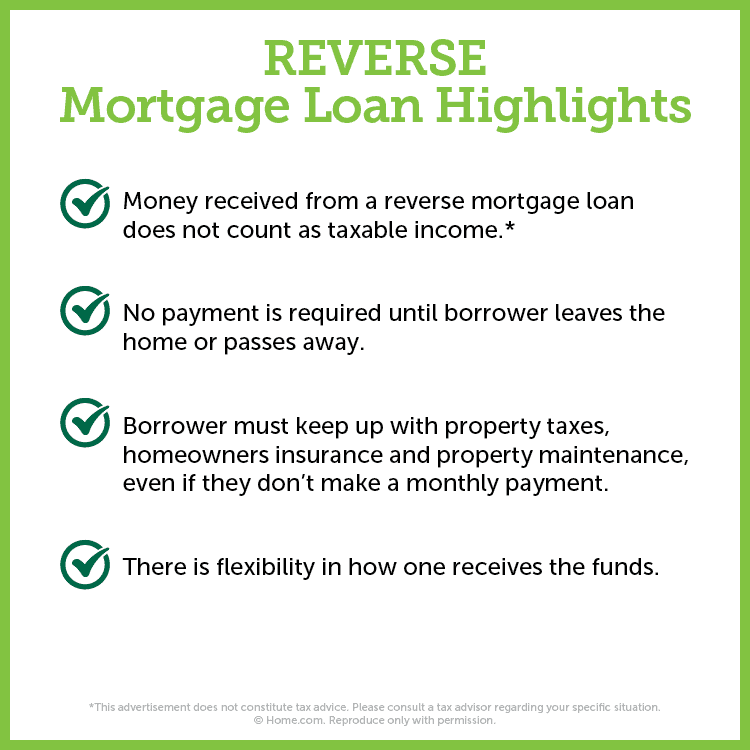

ARMs normally have limitations, or caps, on just how much the passion price can rise each time it adjusts and also in total over the life of the car loan. Various other, less usual sorts of home loans, such as interest-only mortgages and also payment-option read review ARMs, can involve complicated settlement schedules and are best utilized by innovative customers. They are developed for house owners age 62 or older that desire to transform part of the equity in their homes into money.

Just how much you'll have to spend for a home loan depends on the sort of home loan (such as dealt with or adjustable), its term (such as 20 or thirty years), any discount rate points paid, and rate of interest at the time. Rate of interest can differ from week to week as well as from loan provider to lender, so it pays to search.

Our Mortgage Lenders In Knoxville Tn Statements

66% average on a 30-year fixed-rate home loan for the week of Dec. 24, 2020. Prices continued to stay stably reduced throughout 2021 and have begun to climb up progressively given that Dec. 3, 2021 (see the chart below). According to the Federal House Funding Home Mortgage Corp., average rates of interest looked like this pop over to this site as of July 2022:: 5.

Your bank might have lent you cash to buy your house, but instead of having the property, they impose a lien on it (your home is utilized as collateral, however only if the financing goes into default). If you default and foreclose on your mortgage, however, the bank might come to be the brand-new proprietor of your residence.

Consequently, home mortgages allow individuals as well as households to acquire a residence by taking down just a fairly small deposit, such as 20% of the acquisition cost, and obtaining a lending for the balance. The funding is then secured by the worth of the building in situation the customer defaults.

Some Known Details About Mortgage Lenders

Mortgage are just supplied to those that have adequate properties as well as income about their debts to virtually lug the value of a residence gradually. A person's credit report is also examined when making the decision to expand a home loan. The interest price on the mortgage likewise differs, with riskier borrowers getting higher rate of interest prices (Mortgage Lenders).